Last Updated on 11 November 2023 by mysumptuousness.com

Dalton Hogarth, a responsible person not only puts in effort to maintain and grow their wealth but ultimately shares their resources with the less fortunate as well. After all, the hallmark of true wealth is not how much you make, but your generosity in serving others and making a positive impact on society.

A charitable donation can involve giving money, goods, or services to a charitable organization to support many types of causes. Charitable donations can be given as cash, property, stocks, or volunteering your time. The organizations that receive donations can vary widely, ranging from local charities to international aid organizations.

Advantages of Donating to Charity

Donating to charity has many benefits for sponsors and recipients alike. Here are the key advantages of charity giving:

1. Helping those in need.

By donating to charity, you can directly support organizations that provide vital services to those in need, such as food banks, the arts, homeless shelters, crisis centers, and animal rescue groups.

2. Tax benefits.

Donations to registered charities are often tax-deductible, which can help to reduce tax bills and provide financial incentives for giving.

3. Personal fulfilment.

Many people find that donating to charity provides a sense of personal fulfilment and satisfaction, knowing that they are making a difference in the world.

4. Building community.

Charitable giving can help to build a sense of community and connection, as individuals come together to support common causes and goals.

Tax-Deductible Donations

Charity giving can also be an avenue for decreasing tax liabilities by opting for a tax-deductible donation. Tax-deductible donations allow the donor to claim a tax deduction on their income tax return.

To qualify as tax-deductible, donations must be given to registered charities or organizations that have tax-exempt status by the government. The amount of the tax deduction will also depend on the value of the donation and the donor’s tax bracket.

To claim a tax deduction for charitable donations, you must itemize your deductions on your tax returns and provide documentation of your transactions, such as receipts or written acknowledgments from the recipient charitable organization.

Here are some of the documents that may be required to qualify for a tax-deductible donation:

1. Receipts or written acknowledgments.

Itemize the receipts and written acknowledgments from your recipient organization. These documents should include the date and amount of the donation and the organization’s name and tax ID number.

2. Bank statements or checks.

These documents can help to verify the amount and date of the donation and provide further proof of the transaction.

3. Appraisals or valuations.

If the donation is in the form of property, such as artwork or real estate, an appraisal or valuation may be required to determine the fair market value of the donation.

4. Records of non-cash donations.

If the donation is in the form of non-cash items, such as clothing or household goods, individuals may need to keep records of the items donated and their estimated value.

Take note that not all charitable donations are tax-deductible, so it’s important to check with the tax authorities or a financial advisor before donating if you are looking to avail tax benefits. Additionally, tax laws and regulations can vary by country, so it’s important to be aware of the specific rules and requirements in your jurisdiction.

Non-cash Donations

Non-cash donations are donations that are made in the form of goods or services, rather than in cash. Non-cash donations can include:

● Tangible Goods. Donations of goods can include items such as clothing, furniture, books, or household items.

● Securities. Donations of securities, such as stocks or bonds.

● Real estate. Property donations, such as land or buildings.

● Services. Volunteering your time or professional expertise.

Donors may be able to claim a tax deduction for the fair market value of the donated items at the time of the donation.

However, it’s important to note that the specific tax rules and requirements for non-cash donations can vary by country and by the individual’s tax situation. Donors may need to file specific forms that require a description of the items, the date of the donation, and the name and tax ID number of the recipient organization.

Donated items that are more expensive or fall into the higher tax bracket categories (e.g., real estate) may need to be appraised with their tax return.

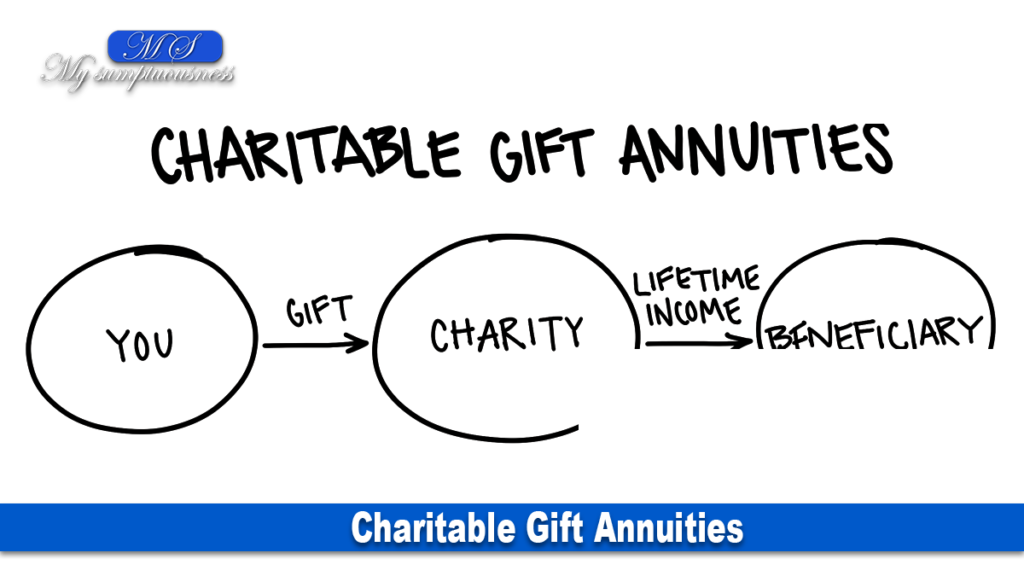

Charitable Gift Annuities

If you want to commit to a chosen charity long-term, then you may opt for a charitable gift annuity. A charitable gift annuity is a type of planned giving in which a donor makes a gift of cash or property to a charitable organization in exchange for a guaranteed, fixed stream of income for life. It is akin to an insurance policy but directed towards a charitable organization instead of an insurance company.

At the time of the gift, the donor and the charitable organization enter into an agreement that outlines the terms of the annuity, including the amount of the gift, the payout rate, and the length of the annuity. The payout rate is determined based on the donor’s age at the time of the gift.

The lump sum payment made by the annuitant/donor is followed by a consistent payout that is typically distributed on a quarterly basis. After the annuitant passes away, the payments stop, and the remaining funds will be given to the charitable organization. Instead of an insurance provider keeping the remaining amount, the charitable organization keeps it as a donation.

Conclusion

Donating to charity is a great way to make a positive impact on the world. However, keep in mind that the specific tax rules and requirements for charitable donations can be complex, and may vary depending on the type of item donated, the value of the donation, and the donor’s tax situation. Consult with a financial advisor to ensure that you are following the correct tax rules and maximizing your tax benefits.

Book a consultation with an expert financial advisor at Dalton Hogarth Tokyo Japan today, and we’ll be happy to assist you.